What's the Difference Between a 1099-NEC and 1099-MISC?

Jan 03, 2026

If you're in your first government accounting role and you're staring at 1099 forms wondering which one goes to which vendor—you’re not alone. The 1099-NEC and 1099-MISC can look almost identical, but they serve very different purposes.

Let’s break it down in plain English, so you can file them confidently and move on with the rest of year-end.

Start Here: What Even Is a 1099?

A 1099 form is how you report money paid to people or businesses who aren’t employees. So if someone worked for your entity but didn’t go through payroll (no W-2), and they got paid $600 or more for their services—you might owe them a 1099.

The IRS uses 1099s to make sure that income gets reported and taxed properly.

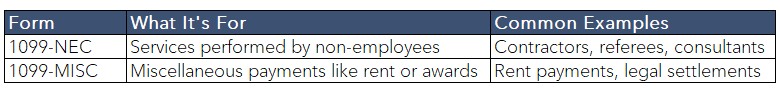

There are several types of 1099s, but in most government accounting offices, you’ll only use two:

-

1099-NEC – For most non-employee services (like contractors or referees)

-

1099-MISC – For other specific types of payments (like rent or legal settlements)

1099-NEC: For Non-Employee Compensation

Think of this as the go-to form when you’ve hired someone to do work for the school, city, county, or other government unit—and they weren’t on payroll.

Use 1099-NEC if you paid someone:

-

$600 or more

-

For services (labor), not products

-

And they aren’t a corporation (exceptions apply)

Examples:

-

A plumber who installed new fixtures (labor portion only)

-

A consultant who helped with a policy review

-

A referee or scorekeeper

-

A guest speaker for a school assembly

-

A part-time grant writer or contractor

NEC = Non-Employee Compensation

That’s why it gets its own form—it’s a direct substitute for employee wages that didn’t go through payroll.

1099-MISC: For Miscellaneous Income

Use this for payments that don’t fit into the “services performed” bucket.

Use 1099-MISC for things like:

-

Rent (e.g., leasing a building or office space)

-

Prizes or awards

-

Certain types of medical or legal payments

-

Payments to attorneys (even if they’re incorporated)

-

Other miscellaneous income not reported on the 1099-NEC

Examples:

-

Paying monthly rent for a Head Start building

-

Giving out a student award in the form of a check

-

Issuing a settlement payment to a legal firm

MISC = Miscellaneous

You’ll likely use this less often—but when you need it, you really need it.

Common Mistakes to Avoid

✅ Don’t report services on the 1099-MISC.

That goes on the 1099-NEC—even if it’s someone you only paid once.

✅ Don’t include materials or product purchases.

If someone invoiced you for labor and materials, only the labor gets reported.

✅ Don’t send a 1099 to a corporation (unless it's an attorney).

C-Corps and S-Corps are generally exempt—unless you're paying them for legal services.

✅ Use the W-9 to guide your decision.

It tells you how the vendor is structured and gives you the info you need to file correctly.

When Do I Send These Forms?

-

Give the form to the vendor by January 31

-

Send it to the IRS (Copy A) by January 31—electronic filing is encouraged

-

Some states also require copies—check your local rules

Most accounting systems will generate these forms for you if you’ve collected W-9s and flagged vendors correctly.

Quick Summary

If You’re Just Getting Started…

If this is your first time handling 1099s:

-

Start early—don’t wait until the end of January

-

Make a list of everyone you paid this year who wasn’t on payroll

-

Request W-9s now if you haven’t already

-

Ask for help when something feels off (even experienced accountants double-check tricky vendors)

You’ve got this. The more you understand the purpose behind these forms, the easier it is to get them right.

Your Next Step Forward

Join the newsletter designed to help CPAs take the next best step in building a practice they love, with practical insights, game-changing tools, and quick wins in every email.

We hate SPAM. We will never sell your information, for any reason.