How to File a 1095 Form: A Simple Guide for Schools and Government Employers

Jan 03, 2026

If you’re responsible for payroll or HR reporting in a school district, city office, or other government entity, you’ve likely heard of Form 1095-C. But what is it, who gets it, and how do you file it correctly?

Let’s walk through the essentials so you can get your Affordable Care Act (ACA) reporting done confidently—and on time.

What Is Form 1095-C?

Form 1095-C is used to report health insurance coverage offered to employees by Applicable Large Employers (ALEs)—that is, employers with 50 or more full-time (or full-time equivalent) employees.

Most schools and government entities meet this threshold and are required to file.

💡 Think of Form 1095-C like a W-2 for health coverage. It shows what coverage was offered, when, and to whom.

Who Gets a 1095-C?

You must provide a 1095-C to:

-

All full-time employees (30+ hours/week on average)

-

Even if they didn’t enroll in coverage

-

Even if they only worked part of the year

If you offered coverage to someone—even if they declined—you still file the form.

What Is Form 1094-C?

This form is the cover sheet for all the 1095-Cs you’re sending to the IRS. It summarizes:

-

Total number of forms submitted

-

Whether you offered minimum essential coverage

-

How many full-time employees you had each month

You don’t send Form 1094-C to employees—it goes to the IRS only.

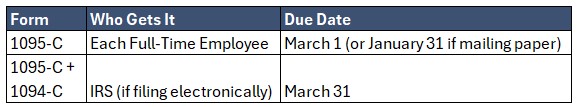

Key Deadlines

🟡 Electronic filing is required if you’re submitting 10 or more forms in total (W-2s, 1099s, 1095s, etc.).

How to File

Most schools use payroll or benefits software to generate 1095 forms. If yours doesn’t, you may need a third-party vendor or to file manually through the IRS AIR (Affordable Care Act Information Returns) system.

✅ Filing steps:

-

Review employee eligibility and hours for each month

-

Determine what coverage was offered (if any), and to whom

-

Use the correct codes for each line (typically Lines 14–16 on the form)

-

Double-check Social Security Numbers and addresses

-

Send employee copies by the deadline

-

Submit all forms to the IRS (with Form 1094-C)

If you're using a vendor (like Aatrix, ACAwise, or your payroll provider), they can walk you through their process.

Understanding the Codes (Line 14–16)

This is the part that often trips people up. Here’s a simplified overview:

-

Line 14: Type of coverage offered (or not offered)

-

Code 1A is the most common for full-time employees with affordable coverage

-

-

Line 15: Employee share of lowest-cost monthly premium for self-only coverage

-

Line 16: Safe harbor codes or other situations (e.g., employee was not full-time, declined coverage, etc.)

📝 Use IRS instructions or software guides to ensure you’re coding these lines correctly. It’s okay to ask for help—especially the first time through.

Tips to Make Filing Easier

-

Start early—gather eligibility and enrollment data throughout the year

-

Make W-9s and updated addresses part of your onboarding process

-

Use your payroll system to track hours and benefits eligibility

-

Keep a running list of common codes and scenarios for your district

Final Thoughts: You Don’t Have to Be an ACA Expert

ACA reporting is detailed, but it doesn’t have to be overwhelming. Whether you file 5 forms or 500, the key is:

-

Start early

-

Use reliable software

-

Ask questions when you're unsure

-

Stay organized year-round

Because at the end of the day, accurate 1095 filing protects your employees, your district, and your peace of mind.

Your Next Step Forward

Join the newsletter designed to help CPAs take the next best step in building a practice they love, with practical insights, game-changing tools, and quick wins in every email.

We hate SPAM. We will never sell your information, for any reason.